|

|

NEW YORK CITY, FEBRUARY 11, 2009 - Luo Ping, director-general at the China Banking Regulatory Commission, gave what may be a landmark quote in the years to come ahead. Besides chastising the United States for its "laissez-faire capitalism" - at which point I distinctly remember choking on my breakfast of delicious jiaozi (I was in Shanghai eating Chinese dumplings) since Ping obviously understands that corporate cronyism is NOT laissez-faire capitalism as fellow columnist Steven McDuffie recently reminds - in retrospect another part of his speech may prove to be the most prophetic. From Reuters:

Except for US Treasuries, what can you hold? Gold? You don't hold Japanese government bonds or UK bonds. US Treasuries are the safe haven. For everyone, including China, it is the only option.

As I related in "China Nearly Doubles its Official Gold Reserves", China revised its official gold holding from 600 tons in 2003 to 1,054 tons last month. However, the very fact that China reported no increase for 6 years and then suddenly doubled should prove one thing - the Chinese are abiding by the IMF Articles of Agreement only as it pleases them. For instance, the state-owned banks can hold as much gold as they wish without reporting, although this gold is de facto the Chinese government's. Please understand that subtlety, not brazen statements like Bush's sad "Mission Accomplished" ceremony or Obama's 100 Days congratulation party, is the Chinese way.

"US Treasuries are the safe haven... the only option."

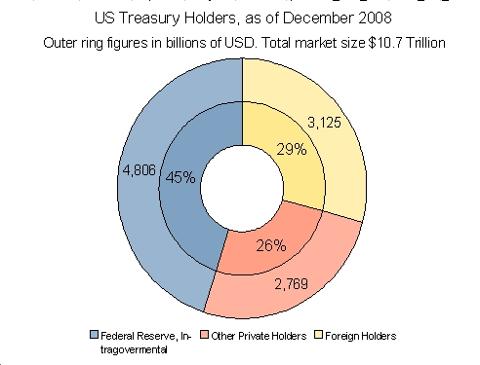

Really? Although March and April data are not available, you could have fooled me! For perspective, the size of the US Treasury market was $10,700,000,000,000 in December 2008. Of this, $727 billion, or 6.8%, belongs to China, and close to one-third is foreign-owned. (Although some would argue that the $4.8 Trillion owned by the Federal Reserve is foreign-owned as well, in actuality this interest is mostly returned to the Treasury as described here "The Federal Reserve - A Good Company to Work For?.") See the chart below (source www.treas.gov).

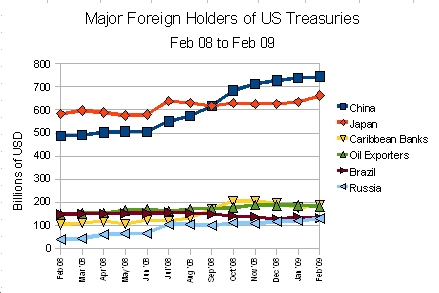

In February, the Obama stimulus plan was passed and planned to be paid - in the future - by US Treasury securities. Now, if the Chinese really believed what they said, in these troubled economic times their cash-rich hands would have been scooping up this "safe haven" like candy. However, in February the amount of US Treasuries in circulation was $11.1 Trillion, while the Chinese "only" increased their holdings by $4.6 Billion, slightly dropping their percent ownership of our country to 6.7%. Upon closer inspection, the rate of decrease in China's Treasury purchases is alarming. From a 53% increase in 2008, the 3-month annualized ratio fell to just 9%. The 1-month non-annualized increase was a meager 0.7%.

(All data for above plots is available from treas.gov here or I can send my Excel file via email request.)

As can be seen, Caribbean Banking Centers (aka "smart money") and Oil Exporters (Saudi Arabia and the Middle East, as well as Venezuela) are actually net sellers at the moment. From the data collected, I believe it will be very wise to keep an eye on the levels reported for March and April.

However, both Congress, the FED and Treasury can view at least the March data right now. Representative Mark Kirk (R-IL), a member of the House Appropriations Committee and co-chair of a group of lawmakers promoting relations with Beijing, stated last week:

It would appear, quietly and with deference and politeness, that China has canceled America's credit card... I'm not sure too many people on Capitol Hill realize that this is now happening.

10-year Treasury yields Monday hit 3.2%, a 6-month high, which is also an indicator demand may have dried up. The FED bought $8.5 billion, and the Treasury plans to offer another $71 billion this week at auction.

"Except for US Treasuries, what can you hold? Gold?"

The answer to this question is, of course, a strong YES! As the Gold Anti-Trust Action Committee (GATA) revealed, the commonly-accepted World Gold Council and GFMS gold holding data have been proven incorrect as they have failed to track the unannounced Chinese accumulations. Since 2003, GATA has surmised that China has been adding continuously to its holdings and offers proof that the gold price has been suppressed here.

As the integrity of the US banking system is compromised, private citizens should consider becoming their own central banks. The days of irredeemable paper fiat currencies may be approaching its end, and there is a reason why the central banks hold gold - it is their default insurance.

Do not be fooled, the gold reserves of central banks are their actual Money. Debt-based paper dollars, yen, pounds are all just ridiculous currencies, sad shadowy mirrors of their former selves, which is gold and silver coin. Gold's manipulated volatility cannot mask its >16% annualized returns versus the USD over the past 8 years. Remember - in actuality, it is the depreciation of the world's fiat currencies we are seeing, not the appreciation of gold itself which is itself both money and a currency as I explained here "Silver and Gold ARE Money (PART 1/2)".

Who will win the Gold War? The simplest answer also holds the most truth. Over the past five thousand years, the winners are those who are holding the gold at the war's end. |

|