|

|

Market Wrap

Economy

First and foremost: a New Year's greeting for health and happiness - and peace throughout the world. As I posted on my website today: after that it's all icing on the cake.

The people of America make up the greatest nation on earth. Whatever we collectively put our minds to will be accomplished. Here's to a prosperous future that we all must build together.

We do have our work cut out for us, but that has never stopped us before. Over $30 trillion in market valuation (50%) has been wiped out during the past year. This is a large blow, but one that can be handled if it is dealt with in the proper manner.

One thing we should be learning from the financial crisis is that something is seriously wrong with the "system" and should be fixed post haste. Confidence in the "system" has been shaken to its roots, as well it should be.

Because of the debacle in the financial markets both individuals and businesses have lost almost all tolerance for risk.

During the prior boom caution had been thrown to the wind. Over-leverage and mal-investments resulted there from. Now the pendulum is swinging to the opposite side, resulting in fear and near panic conditions that are putting a crimp on the global economy.

Stock markets around the world are down hard. Twenty-eight bourses lost more than half their value last year: Russia's lost 67%, China 66%, India 52%, the U.S. 38%, and the U.K. 31%. A good year for stocks it was not. Because of such heavy losses, even the large banks pulled in their horns and stopped lending; in turn causing the credit markets to freeze up.

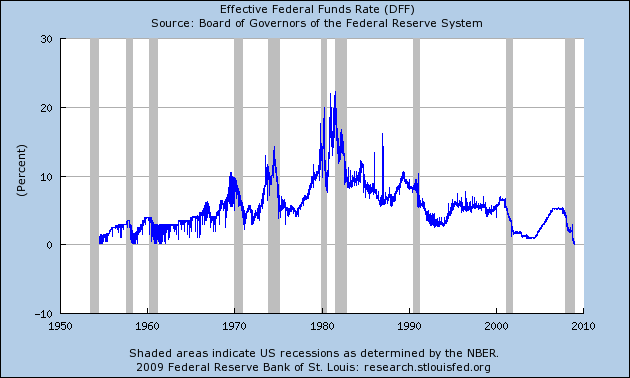

The Federal Reserve and other central banks stepped in to fill the void. Now they were lender of last resort and buyer of last resort as well. The Fed had to get Congress and the Treasury Department behind it to accomplish its goal. At the time this may have seemed like a good idea - it wasn't.

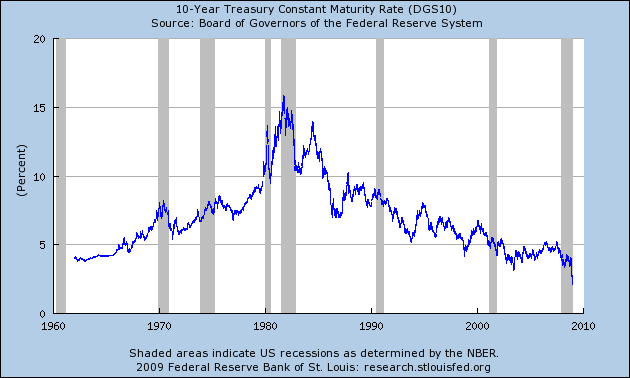

The government should not intervene in what are supposed to be free markets. It was the government's intervention that caused the boom that has gone bust. Excessive credit and debt creation by the Fed is what got us into this mess. Only sound monetary policy and restraint will get us out.

Free market capitalism has taken a severe blow from what amounts to nationalization of the financial markets. The Fed has expanded its assets by 146%, the BOE by 158%, the Swiss National Bank by 74%, and the ECB by 58%.

This is socialism at best and corporate fascism at worst. We the People must wake up and demand accountability for what has occurred. Those like Congressman Ron Paul who long ago warned of what was coming should be listened to for sage advice.

The ultimate cause of the financial debacle is excess credit creation by a self-destructive monetary system of paper fiat debt-money. Money should be gold and silver coin as mandated by the U.S. Constitution.

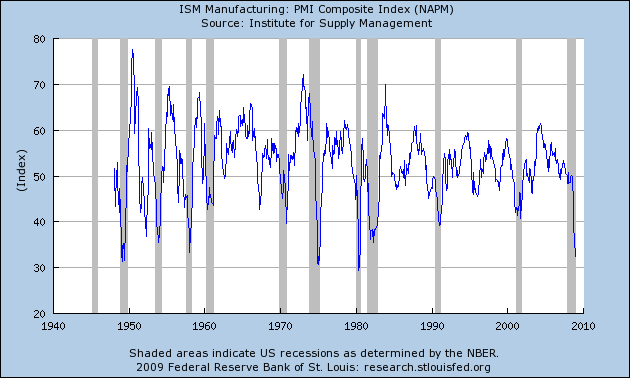

Economies around the world are contracting as a result of the boom turned bust. The Institute for Supply Management's (ISM) factory index fell to 32.4 from the prior month's level of 36.2. Any number under 50 signals contraction.

European factories output fell in December by the largest amount ever recorded. Manufacturing in China fell for a fifth month.

The U.K. reported a decrease for the eighth consecutive month, and Australia was down for the seventh month in a row.

Earlier it was mentioned that the government in partners with the Fed has now stepped in as lender and buyer of last resort. This is not a good omen.

The full faith and credit of the government is backed by We the People's production and earnings. A state can only raise money by taxing the people or by selling debt (borrowing).

Although taxes appear to be the less palpable of the two, remember this: taxes do not require interest payments - debt does.

Who is going to pay the interest on all this debt? - You and me and all Americans.

Former St. Louis Federal Reserve Bank President William Poole had the following to say on the subject:

"There are going to be other industries that are going to have just as good a case."

"We don't know what those other industries are going to be. Where does this process stop?"

And former Fed governor Lyle Gramley added:

"The further you go, the slipperier the slope becomes, the more you open the door to anyone who says, 'Look, my firm is in trouble, I need help too,'"

"We don't want to go any further down that road than we absolutely have to."

In the new guidelines issued the Treasury said,

"Treasury will determine the form, terms and conditions of any investment made pursuant to this program on a case-by-case basis."

"Treasury may consider, among other things, the importance of the institution to production by, or financing of, the American automotive industry."

"Whether a major disruption of the institution's operations would likely have a materially adverse effect on employment and thereby produce negative spillover effects on economic performance."

Stocks

In response to today's dismal ISM report, the market reacted by rallying up over 200 points. Let's hope that this continues the rest of the year. The chart below shows the S&P breaking out just above overhead resistance.

A positive MACD cross is in effect and both RSI and the histograms are turning up into positive territory. A 13/34 crossover may be setting up; and if it occurs it would signal short term strength that is likely to continue.

Price did manage to close above its 50 dma. Any follow through next week would confirm that the short term trend is up. Volume needs to confirm by expanding on any further move up.

Bonds

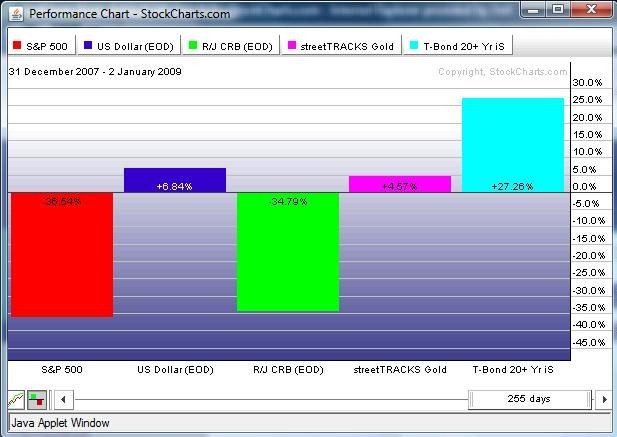

With all the selling in the stock and commodity markets, money flowed into the bond market last year; or more precisely into Treasury bonds.

The chart below shows the big performance from T-bonds. Gold and the dollar showed positive results as well. Commodities got whacked but good.

It is interesting to note that both the dollar and gold were up. This is a bit unusual and bears watching. Either one of the two is going to change direction or the inverse relation between the two is breaking down.

Medium to long term I look for the dollar to align itself with the secular bear market it has been in; and for gold to turn up in line with the secular bull market it has been in.

But Mr. Market will have the final say and we should watch and listen to see what he has to say; and follow suit accordingly.

Gold

Gold gained $8.30 for the week (+0.95%), closing at $879.50 (continuous contract). It was impressive to see gold rally in the face of a rising dollar. Short term - one of the two is going to change direction.

The daily GLD chart below has RSI and the histograms showing negative divergence. MACD is still positive, but looks like it may be starting to roll over. Price is above both its 50 and 200 dma's.

Resistance is marked by the falling trend line and then by the upper rising channel trend line. If the first is broken above, look for the rally to continue.

Support is indicated by the red horizontal line. If that level is broken and closed below, look for a short term correction.

Gold's weekly chart shows the 20/40 ema's positioning for a positive crossover set up.

A positive crossover would confirm the short to intermediate term trend bullish if it occurs and is sustained.

Gold Stocks

Gold stocks have a good week, with the GDX adding +1.07 to close at 33.32 for a +3.32% gain. The precious metal stocks gained 3 to 1 compared to physical gold, however, they underperformed the stock market, which gained almost 7% (S&P).

RSI has a slight negative divergence developing that bears close watching for any further deterioration. The GDX is moving up in a clearly defined bullish price channel as the chart below shows. Horizontal support resides just below as marked by the dotted line.

MACD is flattening out and may be about to curl over. It could just as easily move back up. A day or two of price action will tell. The histograms are receding towards zero and show a negative divergence. Caution is warranted for the short term. There is still plenty of room left to run up if they want to.

The daily Hui chart below shows monthly oversold readings that in the past have led to significant rallies. Remember, this is a long term chart.

Invitation

The above is an excerpt from the full market wrap report available at the Honest Money Gold & Silver Report website. This week's report contains thirty charts & graphs, including six individual stocks on the stock watch list for potential accumulation.

Just made available on the site is an audio version of the book Honest Money. A free copy is included with new subscriptions along with a free two special reports: Investment Vehicles for Bull & Bear Markets; and How to Protect Your Assets in today's turbulent markets.

The first is a list of over 50 ETF's and other investment vehicles offering profit potential on both the long and short side of various markets: stocks, bonds, currencies, gold, oil, water and more.

The second report is a list of actions that can be taken to help protect your assets; including T-Bill Only Money Markets, wire redemptions capabilities to gold depositories, both here and abroad; and much more. Stop by and check it out.

Good luck. Good trading. Good health, and that's a wrap. |

|